Leveraging CFC resources and expertise through investment funds

According to the Global Impact Investing Network, assets under management of impact investors exceeded USD 500 billion in 2018. CFC’s project portfolio (which is 100% impact investing) is relatively small compared to figures like these. However, beyond managing assets, the CFC and other DFIs also play a catalytic role in attracting outside investors to the industry.

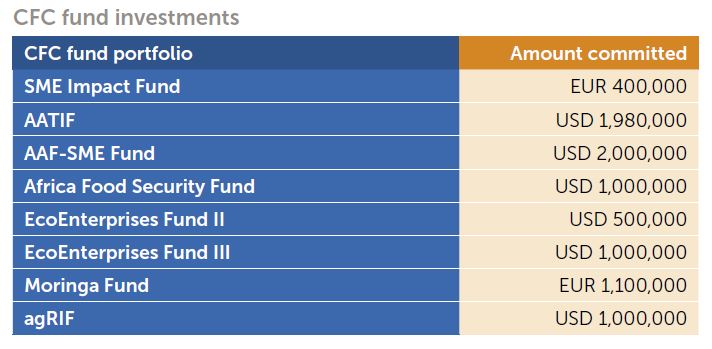

One of the ways CFC does this is by providing the necessary expertise and capital to attract additional resources to new impact funds. Since 2013, the CFC has committed more than USD 9 million to eight impact funds. The CFC furthermore sits on the advisory committees of three of these funds, and manages the technical assistance facility of two others. As a result, the CFC has leveraged both its financial and human capital to contribute to unlocking total commitments of USD 600 million.

Following the CFC mandate

The CFC follows the same impact mandate for investing in both impact funds and making direct investments. However, investing through impact funds has allowed the CFC to increase impact in member countries and value chains with limited or no presence in the CFC loan portfolio. Up to the first half of 2019, the CFC portfolio funds were enhancing the livelihoods of nearly 150,000 beneficiaries and supporting the creation of over 20,000 jobs in 30 countries.

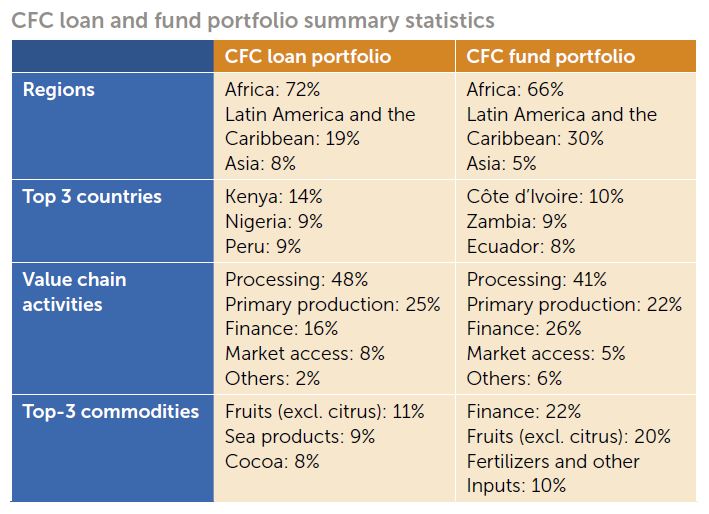

While the regional distribution is similar to the loan portfolio, the fund portfolio has allowed greater country diversification of CFC investments. The biggest recipient of finance across impact funds in the CFC fund portfolio is Côte d’Ivoire, with an average of 10% of total investments. In contrast, the country is in the 17th place in terms of total commitments among CFC loan recipients. Similarly, Zambia, Ecuador and Burkina Faso, which are number two, three and four in the fund portfolio, aren’t even listed as CFC loan recipients.

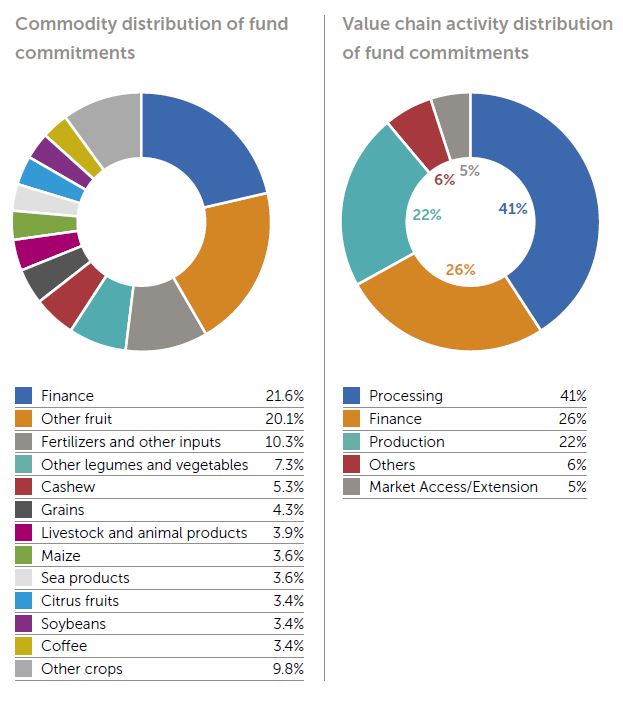

The value chain activities also differ slightly from typical CFC loan projects. In the fund portfolio, refinancing of financial intermediaries servicing rural micro and agri-businesses finance represents about a quarter of total funds committed. Conversely, processing and primary production activities account for a lower share of fund investments. Altogether, compared to direct investments, the fund portfolio is less concentrated on commodities and more focused on supporting activities such as finance and input provision.

The future of CFC fund investments

Through its fund portfolio, the CFC has been able to support the development of the impact investment sector and reach countries and value chains currently not present in the CFC loan portfolio. With several fund investments maturing only in the mid-2020s, the fund impact figures should increase even further in the next few years. In the meantime, the CFC will continue to closely monitor its fund portfolio and share its experience where needed to promote the socioeconomic development of commodity dependent developing countries.