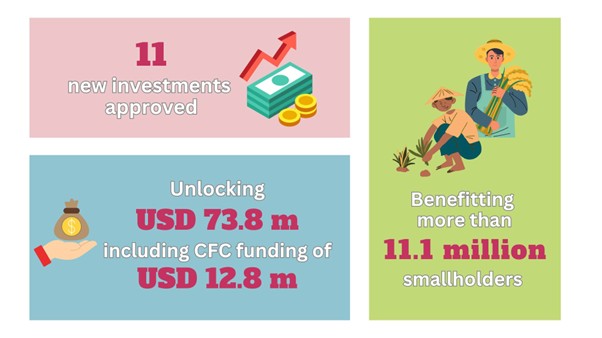

76th Consultative Committee recommends 11 impactful investments expected to benefit over 11.1 million smallholders

Amsterdam, 10 July 2025 — The 76th Consultative Committee (CC76) of the Common Fund for Commodities (CFC), held in the Amsterdam headquarters from 7–10 July 2025, concluded with strong recommendations for financing 11 impactful projects poised to drive inclusive development in commodity-dependent countries. The recommended investments—spanning Africa, Asia, Latin America and Europe—are projected to benefit over 11.1 million smallholder farmers and rural entrepreneurs while contributing to 10 Sustainable Development Goals (SDGs).

These projects, selected from a record 302 proposals under the 26th Call for Proposals, reflect a rising global demand for CFC’s blended finance approach and catalytic capital. The prioritized investments total over USD 12.8 million in CFC funding and are expected to unlock more than USD 73.8 million in total project value.

These projects, selected from a record 302 proposals under the 26th Call for Proposals, reflect a rising global demand for CFC’s blended finance approach and catalytic capital. The prioritized investments total over USD 12.8 million in CFC funding and are expected to unlock more than USD 73.8 million in total project value.

The 11 projects recommended for financing are located in regions like Uganda, Ghana, DR Congo, Côte d’Ivoire, Cameroon, Nigeria, Mexico, Peru, the Philippines, and beyond. The Committee gave particular attention to projects demonstrating strong local ownership, environmental stewardship, gender inclusion, regenerative agriculture, and innovation across value chains.

“Behind each proposal lies a story of resilience and opportunity. These projects are not just about returns—they are about rebalancing global value chains, enabling smallholders to move from poverty to prosperity,” said Ambassador Sheikh Mohammed Belal, Managing Director of the CFC. “With catalytic blended finance and strategic partnerships, we are translating the global Seville Commitment into real action for the world’s rural poor.”

Key recommendations from CC76 include:

- Coffee & Cocoa Value Chains: Support for smallholder coffee cooperatives in Uganda, DR Congo, Mexico, and Peru; expansion of sustainable cocoa processing in Ghana, Nigeria, Cameroon, and the Philippines.

- Spices & Agroforestry: Financing for a Ugandan agribusiness to expand organic vanilla sourcing alongside diversified crops like pineapple and jackfruit.

- Nut Processing: Trade finance for a cooperative-owned cashew processor in Côte d’Ivoire to enhance local value addition and Fairtrade-certified exports.

- Microfinance for Smallholders: Term loan to a global microfinance network to scale access to credit for rural women and smallholder farmers across 17 CFC member countries.

- Inclusive Cocoa Financing: Pre-export working capital facility to support a public-private cocoa sourcing model in Ghana, with direct benefits to farmer income and liquidity.

- Vertically Integrated Agribusiness: Working capital for Nigeria-based cocoa processor and exporter to strengthen local manufacturing and high-value derivative exports.

- Cooperative Empowerment: Financing for established cooperatives in DR Congo and Peru to scale training, certification, and premium market access for coffee producers.

- Climate Resilience & Traceability: Support for cacao value chain innovation in the Philippines to enhance traceability, environmental safeguards, and smallholder certification.

- Women in Agriculture: Project-level commitments to expand women’s inclusion in processing, governance, and farmer training across several value chains.

- Sustainable Trade Finance: Short-term renewable trade finance loans to certified processors and cooperatives in Africa and Latin America to ensure timely crop procurement.

The meeting also highlighted CFC’s growing pipeline of 47 additional projects representing over USD 64 million in potential investment. The Committee took note, with appreciation, of the Fund’s strategic focus on “Humanizing Value Chains” (HVC), an initiative that aims to embed fairness, transparency, and producer empowerment across commodity sectors using tools such as blockchain, traceability systems, and micro-repatriation models.

The meeting also highlighted CFC’s growing pipeline of 47 additional projects representing over USD 64 million in potential investment. The Committee took note, with appreciation, of the Fund’s strategic focus on “Humanizing Value Chains” (HVC), an initiative that aims to embed fairness, transparency, and producer empowerment across commodity sectors using tools such as blockchain, traceability systems, and micro-repatriation models.

Other key developments included:

- The advancement of the Strategic Framework 2025–2035, with contributions from Member States including Colombia, Indonesia, Uganda, and the Philippines;

- The COO also indicated that for the year 2024, the Executive Board approved financing for 18 projects. This was the highest number of approved projects for the last 11 years.

- Updates on the ACT Fund, a new vehicle to mobilize private capital into high-impact agricultural investments;

- The Board also noted the CFC’s ongoing work to improve its impact assessment methodology. Emphasis is being placed on reducing reliance on self-reported data and incorporating publicly available and operational data for more consistent evaluation across the portfolio.

- Continued enhancement of the Fund’s impact assessment and ESG safeguards to ensure that development results are measurable, credible, and inclusive.

As the CFC continues to evolve into a leading blended finance partner, the recommendations of the 76th Consultative Committee mark another critical milestone in delivering finance for systemic transformation across global value chains.

For media inquiries, please contact:

[CFC Media Relations Team]

[Email: managing.director@common-fund.org]

[Phone: +31 20 575 4949]