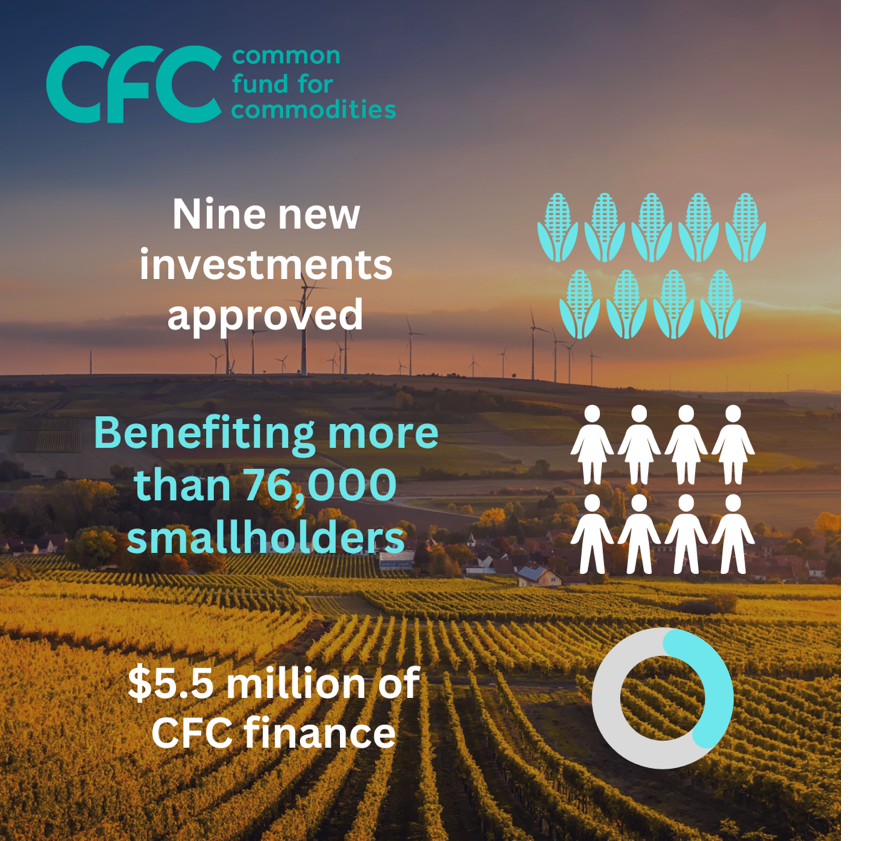

A record 9 investments benefitting thousands of smallholders approved by Executive Board

More than 76,000 smallholder farmers are expected to benefit from investments approved at the Common Fund for Commodities’ (CFC) 75th Meeting of the Executive Board (EB), held on 5 April 2023.

The EB reviewed nine investment proposals, which were submitted through our 21st Call for Proposals and recommended by the Consultative Committee (CC) last January.

After assessing their long-term development potential, the EB approved all the proposals. We will provide USD6.3m of financing as part of an overall value of investments by all partners of USD251m.

After assessing their long-term development potential, the EB approved all the proposals. We will provide USD6.3m of financing as part of an overall value of investments by all partners of USD251m.

The investments include:

- A premium coffee business in Yemen, Colombia, Ecuador and United Kingdom, which is expected to benefit 18,089 smallholders by 2025 (3,120 in 2021) with average of 102% price premium;

- A Fairtrade certified organic honey in Tanzania will increase the beneficiary smallholders from 18000 to 36000 while aiming to provide a price premium of 45 percent over market price. This

honey producer, with this investment, is aiming to become the second largest in the country;

- An organic soyabeans processor in Lome, Togo, that aims to benefit 6,000 smallholder farmers with a 9 percent price premium;

- An agri-business based in the UAE that will benefit the sourcing of premium quality coffee from Nicaragua and Brazil;

- A vanilla producer that expects to benefit about 1,500 smallholders in a remote village of Madagascar so they can sell their organic and Fairtrade certified vanilla at a premium;

- A vanilla producer in Tanzania and Uganda to help thousands of smallholders to sell high valued added natural flavours out of East Africa;

- A coffee business in Peru, which is expected to convert 8,250 hectares of coffee plantations to agroforestry systems for increased carbon storage, while benefitting cooperatives to distribute specialty and premium coffee to 300 SME roasters across 27 countries. On average, the business pays an above-market price to its smallholders. The total volume of premium certified coffee produced by smallholder farmers is expected increase from 880kg/hectare to 1300kg/hectare.

- An innovative fast-track investment in Peru to initiate productive activities that have been pre-approved by an authorized verifier to generate certified carbon credits;

- An equity investment in a Latin American impact investment fund that is expected to benefit thousands of Latin American smallholders, providing income opportunities for rural communities concerned with climate and environment.

As an impact investor, we're committed to achieving the SDGs through investments as approved in this EB. These investments, in addition to addressing CFC’s core Sustainable Development Goals (SDGs) - SDG 1 (No poverty), SDG 2 (Zero hunger), SDG 5 (Gender equality), SDG 8 (Decent work and economic growth), SDG 10 (Reduced inequalities), SDG 13 (Climate action) – they will also address SDG 9 (Industry, innovation and infrastructure), SDG 14 (Life under water), and SDG 15 (Life on land).

Financing agri-SMEs plays a crucial role in driving socio-economic development. Demand for our services is growing, which is reflected in the increasing volume of applications submitted to our Call for Proposals. Throughout 2022, we received a record number of 500 proposals, mostly from agri-SMEs in least developed countries.

CFC Managing Director Amb. Mohammed Belal said: “SMEs are the engine of growth around the world, but they remain severely underfunded. Many agri-SMEs are part of the ‘missing middle’ where there is an investment gap which means they struggle to access finance. This limits their ability to invest in the improved productivity and growth that increases incomes and creates much-needed jobs, particularly in rural areas that suffer from high youth unemployment. With 1.3 billion young people worldwide, including 10 to 12 million new job seekers per year in Africa, jobs created by SMEs are essential to provide economic opportunities and prevent migration.”

The EB also deliberated on the Agricultural Commodity Transformation (ACT) Fund, which we introduced at the 5th United Nations Conference on the Least Developed Countries (LDCs) in Doha, Qatar. This is a new facility for institutional and private sector investors that will benefit from the CFC’s extensive experience building relationships and mitigating risk, to target impact-driven SMEs and smallholder farmers. With its piles of shovel-ready project portfolios, ACT Fund is expected to serve a growing number of SMEs and smallholders in the developing world.

Other items discussed included: impact mapping, Loan Portfolio Management; the project pipeline; Impact Portfolio Management; and financial and administrative matters.

The virtual meeting was chaired by Ms. Tofftén (Sweden). The CC Chair Mr. Philph Ramle Bin Kasin (Malaysia) was also present and reported on the recent CC meeting.