Investing in SMEs at the heart of transforming global agriculture

International trade, which has boosted economic growth and improved access to new innovations and technologies, has played a significant role in reducing extreme poverty in the past, and it can do so in the future. But while trade can lift economic growth, the poor do not automatically benefit from new trade opportunities. Many people simply face too many obstacles to benefit from increased trade. This is more so at a challenging time like this.

At a time when poverty is crawling back, instead of receding, there is a large section of smallholders face higher production, marketing costs and are less able to access financial services. Despite improvements in some developing countries, even the poorest sectors of the population still face financial costs for basic services, and uneven public service delivery translates into higher costs in remote rural areas. Given the reduced access to concessional capital experienced by smallholders and the simultaneous need to insure against higher risk push smallholders into short-term selling to middlemen or increase side selling among organized producers.

Indeed, in times of economic downturns, smallholders in the agricultural sector often fall into poverty without any type of social safety net. And more than 40% of the extreme poor live in fragile and conflict-affected areas, creating a major hurdle for the poor to reap the gains from trade.

This is why CFC is working for last three decades to provide an avenue to commodity producing smallhodlers to benefit from trade using a smallhodlers and SMEs (small and medium enterprises) nexus.

With over 500 applications in a year, the Common Fund of Commodities (CFC) is convinced that this is the time to move ahead with this new fund-the Agricultural Commodity Transformation Fund (ACT Fund) with due approval from our Governing Council, the highest plenary of the CFC.

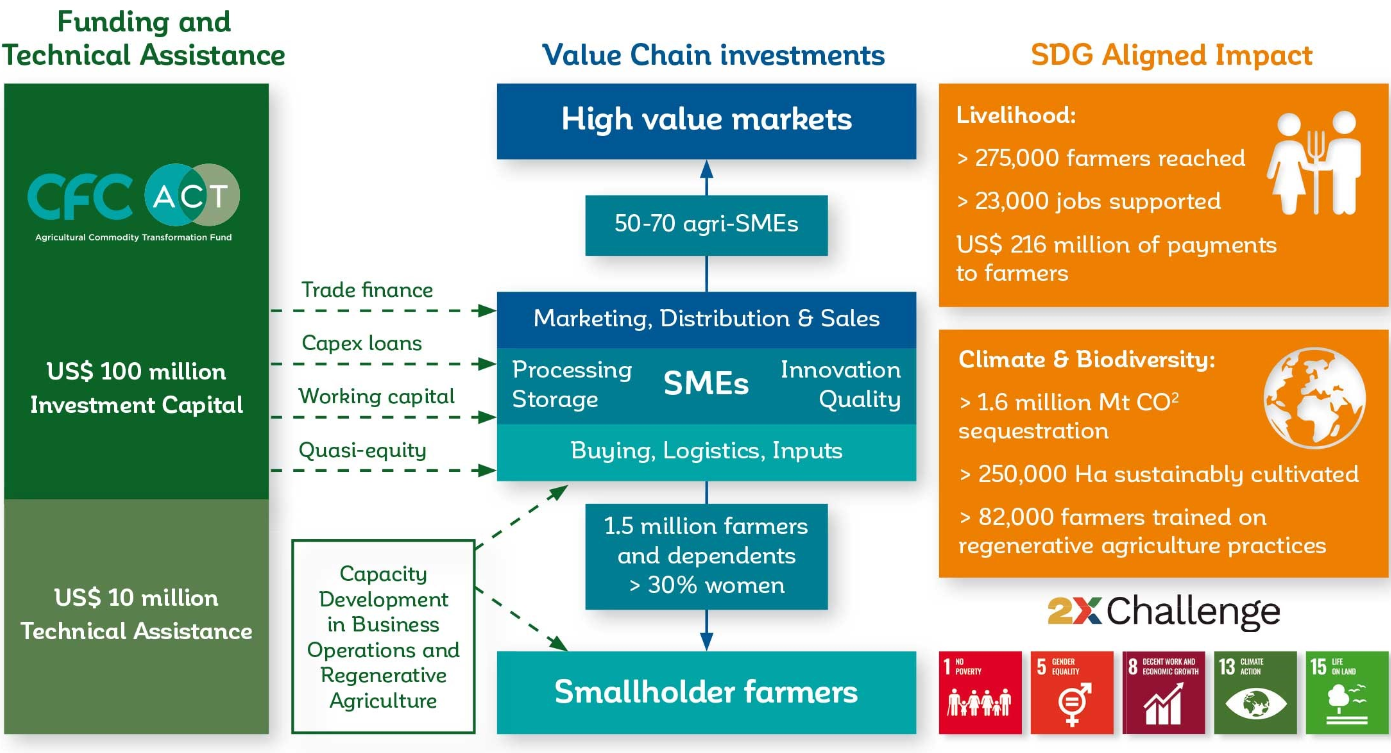

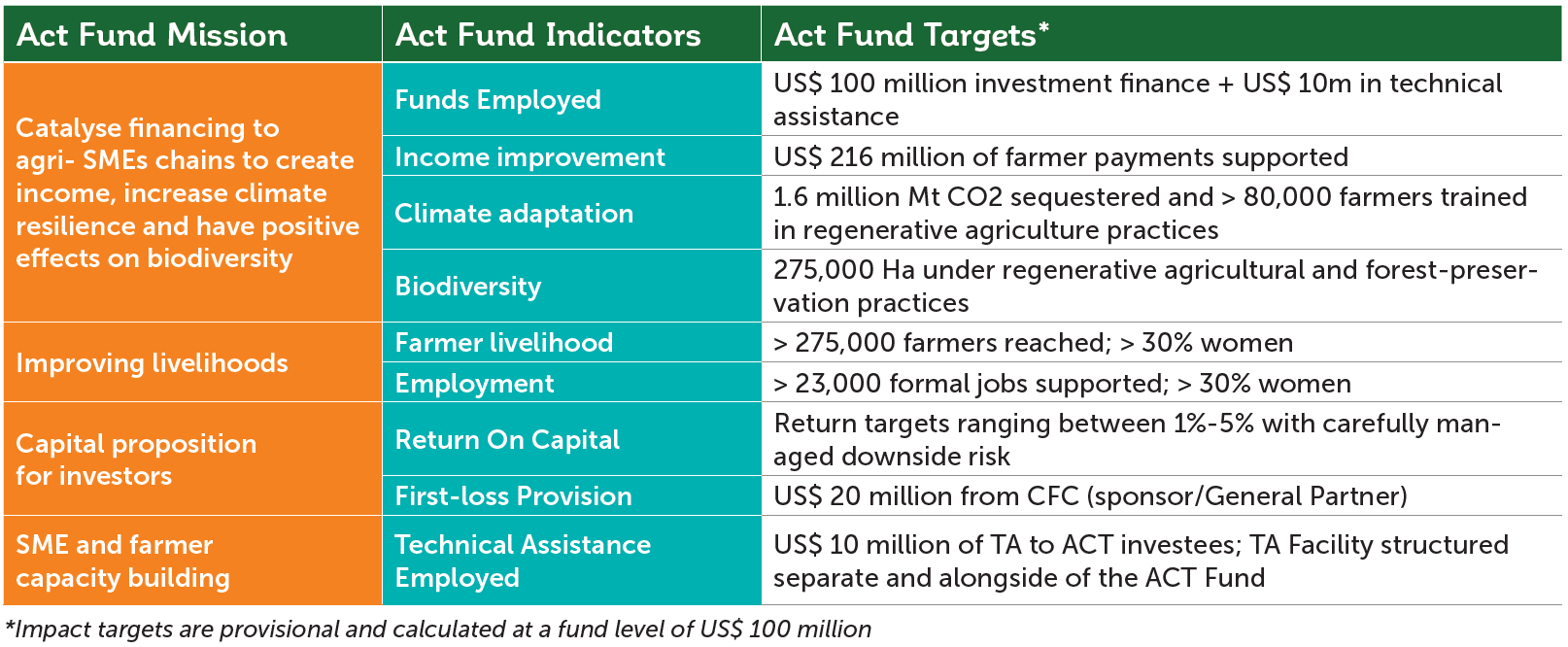

ACT is a US$ 100 million impact fund that will invest in SMEs in developing countries at the nexus of smallholder livelihoods, biodiversity and climate action. ACT will unlock the potential of agri-SMEs to create income and climate resilience at scale while preserving natural capital.

ACT focusses on enabling viable small and medium sized enterprises (SMEs) to create greater economic opportunity in the communities around them, while strengthening the climate resilience of their value chains and growing the incomes of the smallholder farmers they work with. By enhancing the relationship between SMEs and smallholders, ACT will support rural development that alleviates poverty.