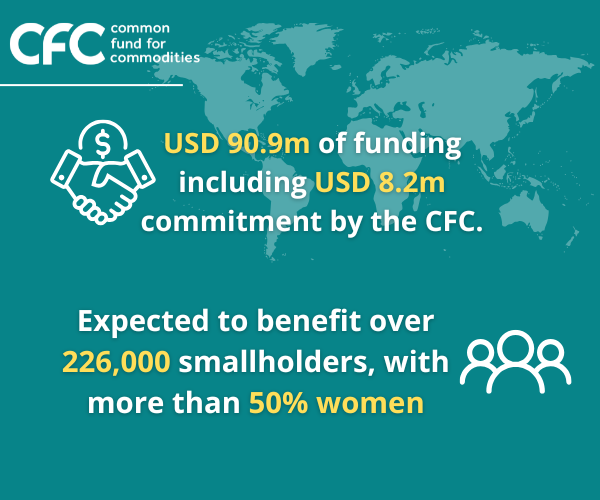

75th Consultative Committee Recommends 10 Investments to benefit over 226,000 smallholders, with more than 50% women

Amsterdam, 30 January 2025 – The 75th Meeting of the Consultative Committee (CC) of the Common Fund for Commodities (CFC) concluded with the recommendation of 10 new investments for consideration by the Executive Board (EB). If approved, these projects will benefit over 226,000 smallholder farmers and agribusinesses across various commodity sectors, fostering economic growth and sustainability in some of the world’s most at-risk regions.

These investments will unlock USD 90.9 million in financing, including a USD 8.2 million commitment by the CFC. The financing proposed for these projects will strengthen value chains in coffee, cocoa, spices, seafood, nuts, fruits, microfinance, and agricultural leasing. Carefully selected from 190 proposals submitted under the 25th Call for Proposals, these investments aim to boost productivity, expand market access, and foster long-term economic growth and opportunities.

Diverse Investments in Key Commodity Sectors

The recommended projects cover a wide range of commodities and regions, including:

- Coffee & Cocoa Value Chains: Support for specialty coffee cooperatives in Guatemala, expansion of sustainable cocoa production in Sierra Leone, and financing for smallholder coffee and cocoa producers in Colombia and Indonesia.

- Spices & Essential Oils: Investment in the Honduran spice and essential oil sector, enhancing local value addition and export opportunities.

- Seafood & Aquaculture: Expansion of sustainable seafood processing and tilapia farming in Kenya, ensuring higher incomes for small-scale fish farmers.

- Nut Production: Strengthening the macadamia nut sector in Kenya, supporting female-led agribusinesses and improving processing capabilities.

- Fruits & Agri-Processing: Expansion of fruit processing and export operations in Egypt, enhancing market linkages for smallholder farmers.

- Microfinance for Smallholders: Scaling up financial services for smallholder farmers in Pakistan, providing access to credit, inputs, and insurance through a dedicated agri-financing platform.

- Agricultural Leasing: Expansion of lease financing for agricultural equipment in Tanzania, ensuring SMEs and farmers can access the machinery needed to improve productivity.

Innovation and Economic Growth Through Impact-Driven Investments

CFC Managing Director Ambassador Sheikh Mohammed Belal underscored the importance of targeted financing in the commodity sector, stating:

“These investments represent more than just financial commitments—they are a direct response to the pressing challenges faced by smallholder farmers and agribusinesses in developing countries. By investing in locally driven solutions, we can unlock new markets, improve livelihoods, and create a more equitable and resilient global food system.”

Key highlights of the meeting included a focus on digitization and sustainable value chain financing, along with an endorsement of collaborative frameworks, such as the ongoing work of the Agricultural Commodity Transformation (ACT) Fund.

With commodity-dependent economies facing persistent trade inequities, climate challenges, and market fluctuations, the CFC remains committed to bridging financial gaps and humanizing the agricultural value chain, ensuring that the benefits of growth are shared by those who need them most.

Next Steps

The 10 projects recommended by the CC will now move forward for consideration by the CFC Executive Board. If approved, they will be implemented ensuring sustainable economic impact in the target regions.

The CC is composed of nine commodity experts from different regions, who are elected for a term of two years. They meet twice a year to discuss and recommend investments in commodity-related businesses for consideration by the EB.

For more information, please visit www.common-fund.org or write to us at managing.director@common-fund.org .

The projected number of smallholder beneficiaries, in addition the expected percentage of female beneficiaries, is based on anticipated impact figures reported by potential investees of the CFC. These figures have been reviewed by the CFC’s Consultative Committee and will be subject to further due diligence.